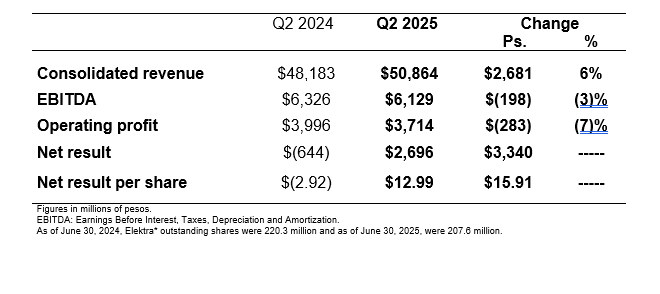

Grupo Elektra announces EBITDA of Ps.6,129 million and operating income of Ps.3,714 million in the second quarter of 2025

México City, July 28, 2025—Grupo Elektra, S.A.B. de C.V. (BMV: ELEKTRA* Latibex: XEKT), Latin America’s leading specialty retailer and financial services company, and the largest non-bank provider of cash advance services in the United States, today announced second quarter 2025 results.

Second quarter results

Consolidated revenue was Ps.50,864 million, compared to Ps.48,183 million in the same quarter of the previous year. Operating costs and expenses totaled Ps.44,736 million, up from Ps.41,857 million in the same quarter of 2024.

As a result, EBITDA was Ps.6,129 million, compared to Ps.6,326 million a year ago. Operating income was Ps.3,714 million, up from Ps.3,996 million in the same period of 2024.

The company reported a net income of Ps.2,696 million, compared to a loss of Ps.644 million a year ago.

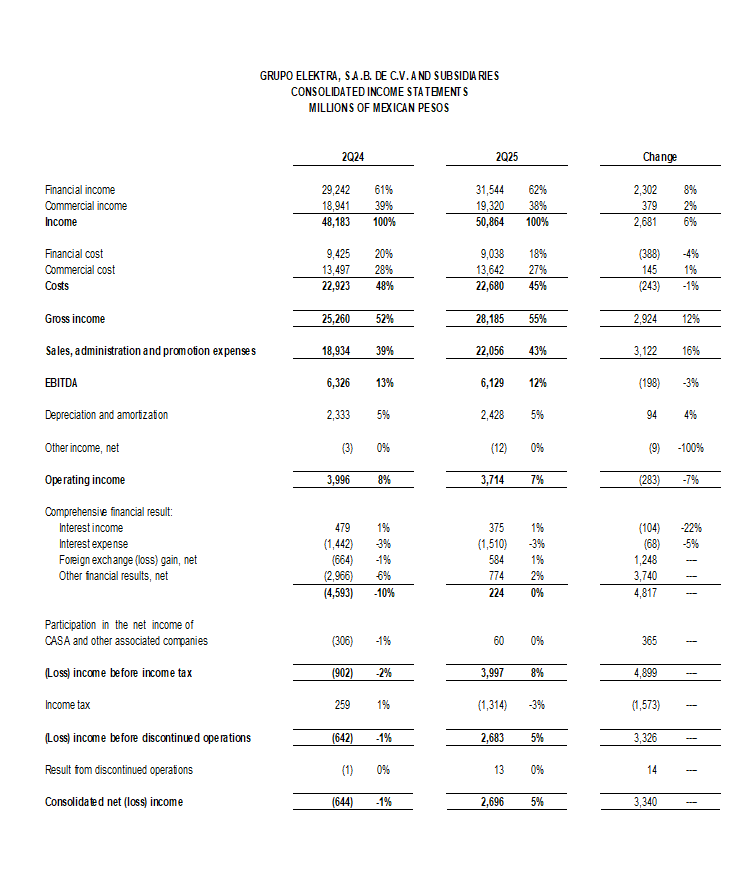

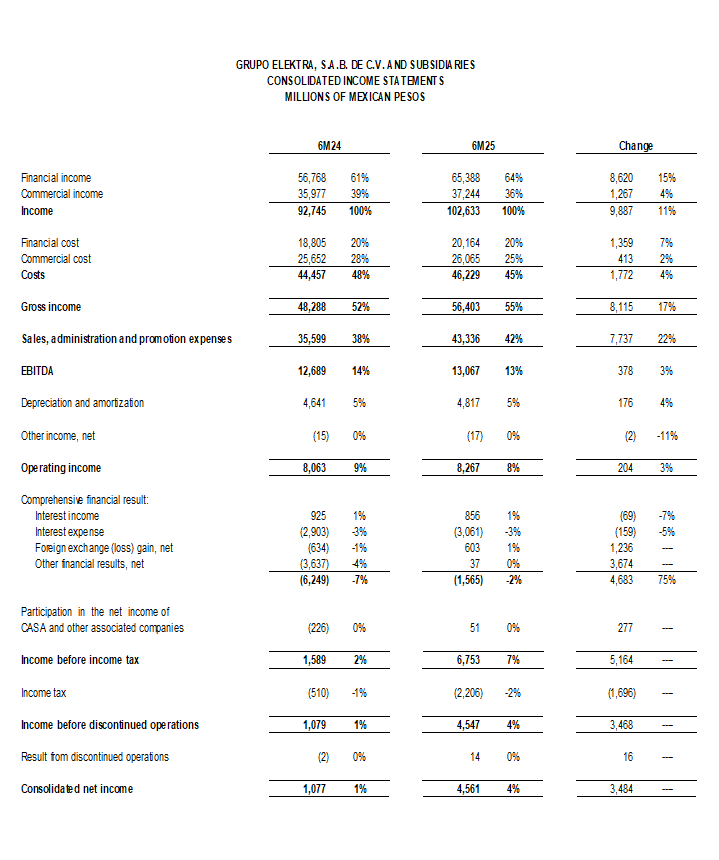

Revenue

Consolidated revenue for the quarter is comprised of Ps.31,544 million in financial business revenue and Ps.19,320 million in commercial business revenue, while a year ago, financial business revenue was Ps.29,242 million and commercial business revenue was Ps.18,941 million.

Costs and expenses

Consolidated costs were Ps.22,680 million, up from Ps.22,923 million in the previous year, while sales, administrative and promotion expenses totaled Ps.22,056 million, compared to Ps.18,934 million in the same period 2024.

EBITDA and net result

EBITDA was Ps.6,129 million, up from Ps.6,326 million the previous year.

Relevant changes below EBITDA were as follows:

An increase of Ps.94 million in depreciation and amortization, largely due to an increase in fixed assets in use.

An increase of Ps.68 million in interest expense, resulting from a higher balance of debt with cost at the end of the quarter compared to the previous year.

A gain of Ps.584 million in foreign exchange this quarter, compared to a foreign exchange loss of Ps.664 million a year ago, as a result of a net liability monetary position, combined with the appreciation of the peso against the dollar this period, compared to depreciation the previous year.

A positive variation of Ps.3,740 million in other financial results, reflecting an 8% gain this quarter in the market value of the underlying financial instruments held by the company — and which do not imply cash flow — compared to an 8% loss a year ago.

Consistent with the quarter's results, there was an increase of Ps.1,573 million in tax provision for the period.

Grupo Elektra reported a net income of Ps.2,696 million, compared to a net loss of Ps.644 million a year ago.

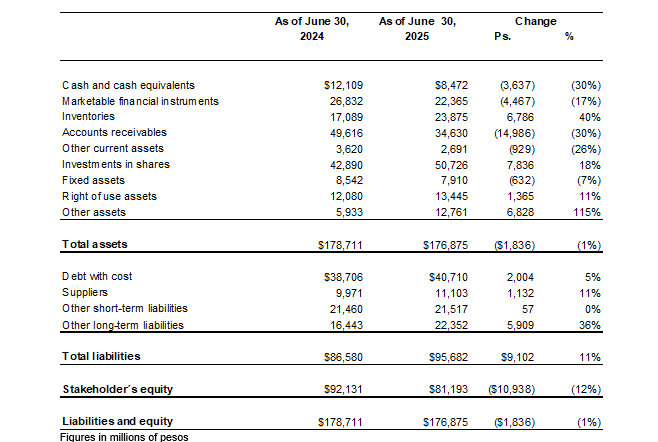

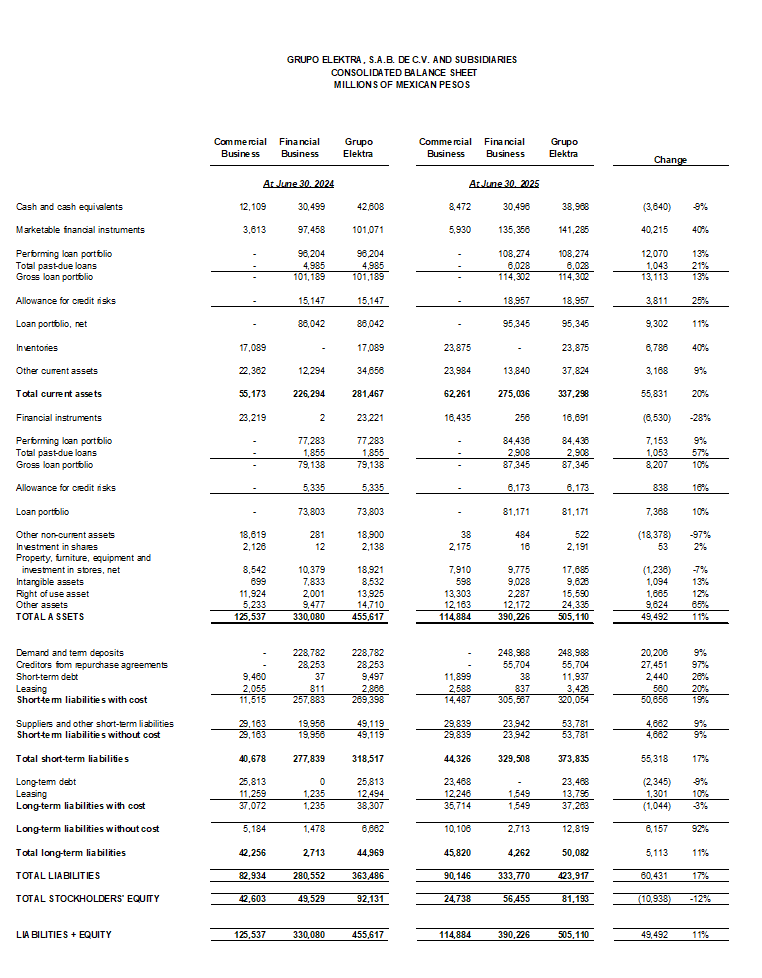

Unconsolidated balance sheet

A proforma balance sheet exercise of Grupo Elektra is presented, which allows to know the non-consolidated financial situation, excluding the net assets of the financial business.

In line with the above, debt with cost as of June 30, 2025, was Ps.40,710 million, compared to Ps.38,706 million the previous year. The increase reflects the issuance of fiduciary certificates and credit drawdown this period.

Cash and cash equivalents were Ps.8,472 million, up from Ps.12,109 million a year earlier, and net debt was Ps.32,238 million, compared to Ps.26,597 million a year ago.

Consolidated Balance Sheet

Loan Portfolio and Deposits

The consolidated gross loan portfolio of Banco Azteca Mexico, Purpose Financial, and Banco Azteca Latinoamerica as of June 30, 2025, was Ps.201,647 million, up from Ps.180,327 million the previous year. The consolidated non-performing loan ratio was 4.4% at the end of the period, compared to 3.8% the previous year.

Banco Azteca Mexico's gross loan balance was Ps.193,792 million, up from Ps.173,266 million a year ago. The bank's delinquency ratio at the end of the period was 4.1%, compared to 3.2% the previous year.

Grupo Elektra's consolidated deposits totaled Ps.248,988 million, compared to Ps.228,782 million a year ago. Banco Azteca México's traditional deposits totaled Ps.241,451 million, up from Ps.224,808 million the previous year.

Banco Azteca Mexico's capitalization ratio was 14.71%.