Grupo Elektra announces remarkable 1.5-times growth in EBITDA, to Ps.5,557 million in Q3 2021

- Solid performance of both commercial and financial businesses generates 20% increase in consolidated revenue, to Ps.35,504 million

- Strong growth in the loan portfolio of Banco Azteca México; increases 13%, to Ps.111,888 million

Mexico City, October 27, 2021—Grupo Elektra, S.A.B. de C.V. (BMV: ELEKTRA* Latibex: XEKT), Latin America’s leading specialty retailer and financial services company, and the largest non-bank provider of cash advance services in the United States, today announced third quarter 2021 financial results.

Third Quarter Results

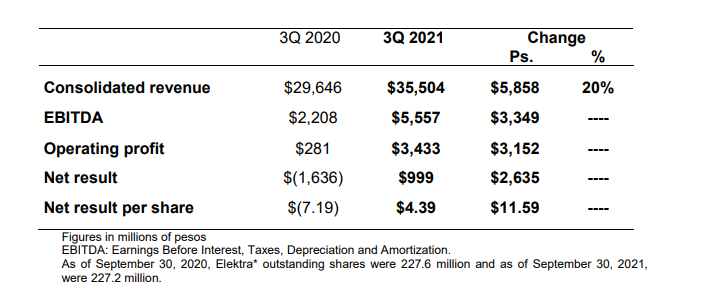

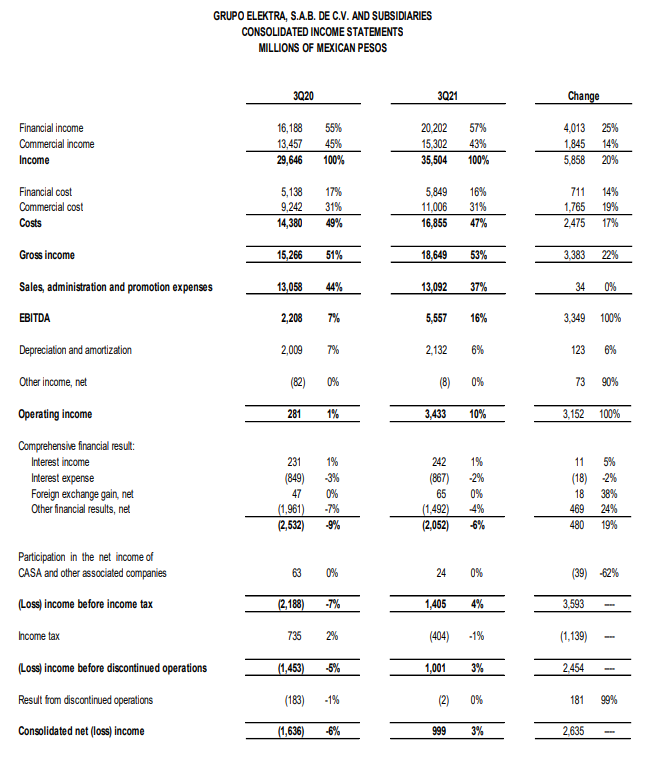

Consolidated revenue grew 20%, to Ps.35,504 million in the period, compared to Ps.29,646 million in the same quarter of the previous year. Operating costs and expenses were Ps.29,947 million, from Ps.27,438 million in the same period of 2020.

As a result, EBITDA was Ps.5,557 million, compared to Ps.2,208 million a year ago. Operating income was Ps.3,433 million this quarter, from Ps.281 million in the same period of 2020.

The company reported net income of Ps.999 million, compared to a net loss of Ps.1,636 million a year ago.

Revenue

Consolidated revenue increased 20% in the period, as a result of a 25% growth in financial income and a 14% increase in commercial sales.

The increase in financial income — to Ps.20,202 million, from Ps.16,188 million in the previous year — reflects a 29% increase in Banco Azteca México's income, in the context of strong growth in the gross loan portfolio in the period, which boosts the well-being of millions of families and the expansion of activities of thousands of businesses.

The increase in sales of the commercial business — to Ps.15,302 million, from Ps.13,457 million a year ago — results largely from solid growth in sales of Italika motorcycles — which enhances business productivity and mobility of families — and telephony — that strengthens the connectivity of an increased number of users — commercialized with optimal customer service, in the most competitive market conditions.

Sales of the commercial business had an additional boost with the development of new stores with a format that offers an optimal mix of merchandise and services, and allows to maximize the customer's shopping experience. Similarly, the Omnichannel operations, with the online store www.elektra.com.mx, which sells thousands of products at unparalleled prices, from any device and at any time, further strengthened business performance.

Costs and Expenses

Consolidated costs for the quarter grew 17%, to Ps.16,855 million, from Ps.14,380 million in the previous year, as a result of a 19% increase in commercial cost — consistent with higher revenue from merchandise sales — and an increase of 14% in the cost of the financial business, derived from the increase in loan loss reserves, in line with the growth of the gross loan portfolio in the period.

Selling, administrative and promotional expenses were Ps.13,092 million practically unchanged from Ps.13,058 million a year ago, as a result of higher operating expenses, offset by reductions in personnel and advertising expenses. The stability in expenses, compared to the growing income in the period, reflects the implementation of strategies that effectively enhance the operating efficiency of the company.

EBITDA and net result

EBITDA was Ps.5,557 million, from Ps.2,208 million from the previous year. The company reported operating income of Ps.3,433 million, compared to Ps.281 million in the same quarter of 2020.

The most important variation below EBITDA was an increase of Ps.469 million in other financial results, which reflects a 3% reduction this quarter in the market value of the underlying financial instruments that the company owns — and that does not imply cash flow — compared to a 5% decrease a year ago.

Consistent with the results of the quarter, there was an increase of Ps.1,139 million in the provision for taxes in the period.

Grupo Elektra reported net income of Ps.999 million, from a loss of Ps.1,636 million a year ago.

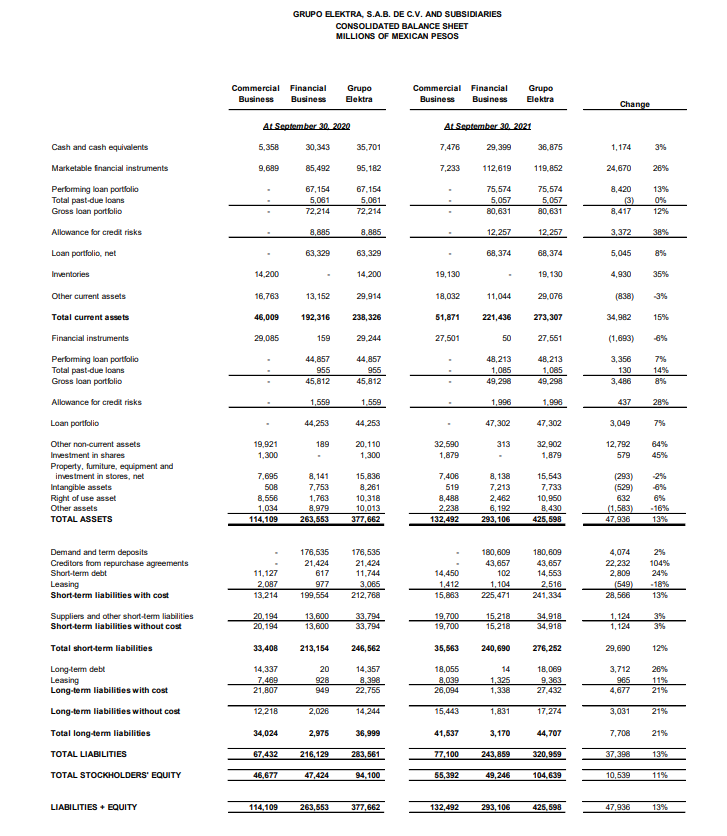

Unconsolidated Balance Sheet

In order to allow the visualization of the non-consolidated financial situation, a pro forma exercise of the balance sheet of Grupo Elektra is presented, excluding the net assets of the financial business, whose investment is valued under the equity method, in this case.

This presentation shows the debt of the company without considering Banco Azteca’s immediate and term deposits, which do not constitute debt with cost for Grupo Elektra. The pro forma balance sheet also does not include the bank's gross loan portfolio.

This proforma exercise provides greater clarity regarding the businesses that make up the company and allows financial market participants to estimate the value of the company, considering only the relevant debt for such calculations.

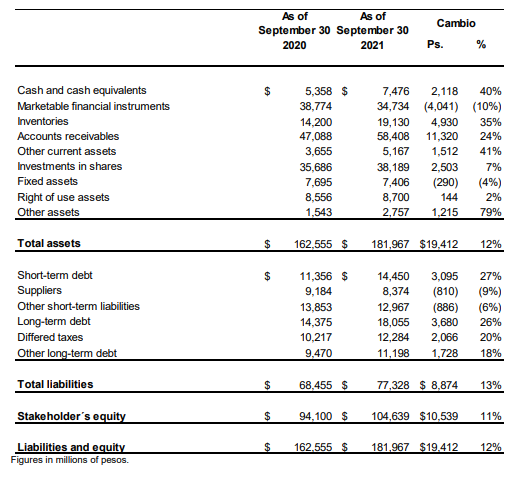

Consistent with this, the debt with cost was Ps.32,505 million as of September 30, 2021, compared to Ps.25,731 million in the previous year. The balance of cash and cash equivalents was Ps.7,476 million, from Ps.5,358 million from the previous year. As a result, net debt as of September 30, 2021, was Ps.25,029 million, compared to Ps.20,373 million a year ago.

As previously announced, during the first quarter, Grupo Elektra's subsidiary, Nueva Elektra del Milenio, S.A. de C.V., as originator, placed through a special purpose vehicle established under Luxembourg law, Senior Notes for US$500 million, for seven years, at a 4.875% rate, in international markets.

On the other hand, during the quarter, Certificados Bursátiles Fiduciarios for Ps.2,030 million were early amortized. The amount corresponds to the outstanding balance of the DINEXCB 16 issues — for Ps.1,350 million due 2023 with a rate of TIIE + 2.8% — and DINEXCB 16-2 for Ps.680 million, due 2026 and a fixed rate of 8.8%.

As of September 30, 2021, the company's stockholders' equity was Ps.104,639 million, and the stockholders' equity to total liabilities ratio was 1.35 times.

Consolidated Balance Sheet

Loan Portfolio and Deposits

Banco Azteca Mexico, Purpose Financial and Banco Azteca Latin America’s consolidated gross portfolio as of September 30, 2021, grew 10%, to Ps.129,929 million, from Ps.118,026 million the previous year. The consolidated delinquency rate was 4.7% at the end of this period, compared to 5.1% the previous year.

Banco Azteca México's gross portfolio balance increased 13% to Ps.111,888 million, from Ps.99,395 million a year ago. The Bank's delinquency rate at the end of the quarter was 4.7%, compared to 5.1% the previous year.

The average term of the credit portfolio for principal credit lines — consumer, personal loans, and Tarjeta Azteca — was 64 weeks at the end of the third quarter.

Grupo Elektra's consolidated deposits were Ps.180,609 million, compared to Ps.176,535 million a year ago. Banco Azteca México's traditional deposits were Ps.177,908 million, from Ps.170,634 million from the previous year.

The ratio of deposits to gross portfolio of Banco Azteca Mexico of 1.6 times, strengthens the solid growth prospects of the Bank, with optimal funding cost.

The capitalization ratio of Banco Azteca México was 14.8%.

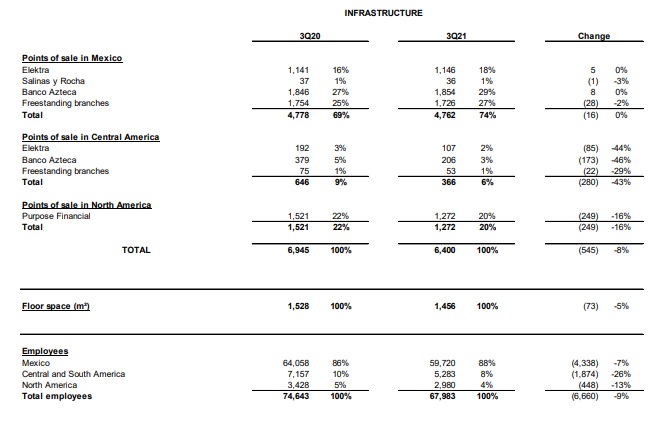

Infrastructure

Grupo Elektra currently has 6,400 points of contact, compared to 6,945 units the previous year. The decrease is mainly due to the closure of 280 contact points in Latin America, largely derived from the sale of Banco Azteca del Peru in the fourth quarter of 2020, as well as the closure of 249 contact points of Purpose Financial in the United States — in the context of strategies aimed at boosting online credit operations and strengthening the company's operating efficiency.

In Mexico, in the last twelve months, 20 new Elektra stores were opened in strategic locations, with a format that offers an optimal mix of products and services, and allows the customer to maximize the purchase experience.

The company has 4,762 storefronts in Mexico at the end of the quarter, 1,272 in the United States, and 366 in Central America. The important distribution network allows the company to maintain close contact with customers and grants a superior market positioning in the countries where it operates.

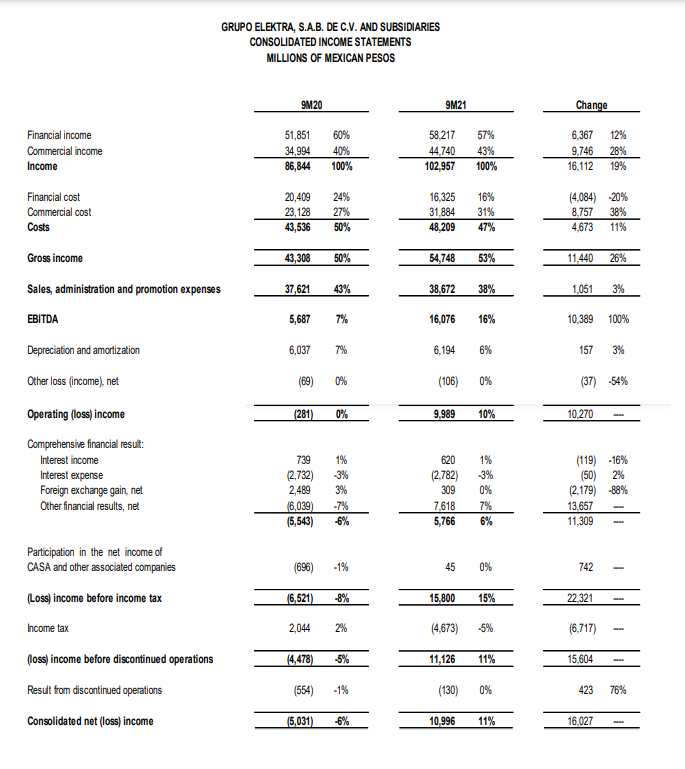

Nine-month consolidated results

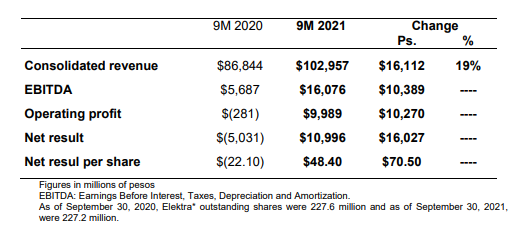

Consolidated revenues in the first nine months of the year grew 19%, to Ps.102,957 million, from Ps.86,844 million registered in the same period of 2020, driven by a 28% growth in sales of the commercial business and 12% in financial business income.

EBITDA was Ps.16,076 million, compared to Ps.5,687 million in the previous year. The company reported operating income of Ps.9,989 million, from an operating loss of Ps.281 million a year ago.

In the first nine months of 2021, a net income of Ps.10,996 million was recorded, compared to a loss of Ps.5,031 million a year ago. The change reflects superior operating results this period, as well as a gain in the market value of the underlying financial instruments that the company owns — and that does not imply cash flow — compared to loss in the previous year.