TV Azteca announces Net Revenue of Ps.3,583 million and EBITDA of Ps.985 million in the 3Q21

Mexico City, October 26, 2021—TV Azteca, S.A.B. de C.V. (BMV: AZTECACPO Latibex: XTZA), one of the two largest producers of Spanish-language television programming in the world, today announced financial results for the third quarter 2021.

"The gradual recovery of economic activity indicators strengthened the advertising market in Mexico in the period, which, together with the company's competitive content and our special coverage of segments of the Tokyo Olympic Games and the soccer Gold Cup, boosted the demand of numerous advertisers for commercial spaces on TV Azteca," commented Rafael Rodríguez, CEO of TV Azteca." In order to preserve the financial and operational viability of the company, we developed strategies that effectively controlled production costs in all of our programs, which, in the context of increased revenues, generated higher EBITDA levels in the quarter."

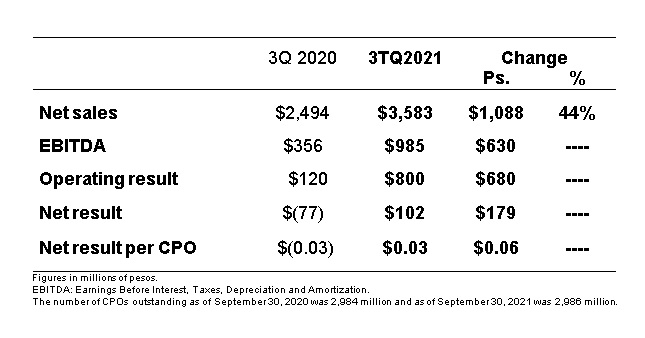

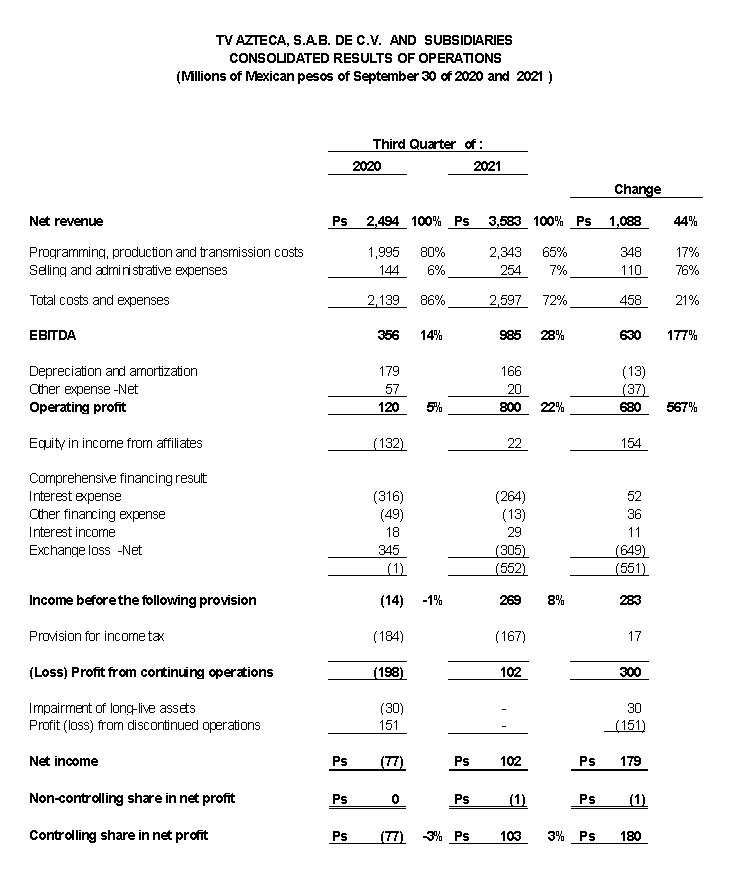

Third quarter results

Net revenue for the period was Ps.3,583 million, 44% higher the Ps.2,494 million for the same quarter of last year. Total costs and expenses increased 21% to Ps.2,597 million, from Ps.2,139 million for the previous year.

As a result, the company reported EBITDA of Ps.985 million, compared to Ps.356 million a year ago. TV Azteca generated operating income of Ps.800 million, from an operating income of Ps.120 million in the previous year.

The company recorded net income of Ps.102 million, compared to net loss of Ps.77 million in the same period of 2020.

Net sales

The company's advertising sales in Mexico grew 47%, to Ps.3,409 million, from Ps.2,322 million in the previous year, in the context of an improvement in the performance of domestic economic aggregates, as well as the transmission of segments of sporting events such as the Tokyo Olympics and the 2021 soccer Gold Cup.

The sum of revenue of TV Azteca Guatemala and TV Azteca Honduras, as well as the company's content sales outside of Mexico, was Ps.62 million, compared to Ps.59 million the previous year.

Azteca Comunicaciones Perú reported revenue of Ps.112 million from Ps.113 million a year ago. The revenue resulted from telecommunications services and reimbursements from the Peruvian government for maintenance and operation of the fiber optic network.

Costs and SG&A Expenses

Total costs and expenses increased 21% in the quarter as a result of a 17% growth in production, programming and transmission and telecommunications services costs — to Ps.2,343 million, from Ps.1,995 million a year ago — together with a 76% increase in selling and administrative expenses, to Ps.254 million, compared to Ps.144 million from the previous year.

The increase in costs, which was lower than the revenue growth this period, reflects strategies that strengthen efficiencies in the content production process, which preserve the operational viability of the company, while maintaining the superior quality of the programming.

The costs of Azteca Comunicaciones Perú were Ps.56 million, from Ps.85 million a year ago. The reduction is mainly due to lower costs for the maintenance of the transmission infrastructure.

The increase in selling and administrative expenses reflects fees related to financial advisory services in the period, partially offset by lower operating, travelling and personnel expenses.

EBITDA and net results

The company's EBITDA was Ps.985 million, compared to Ps.356 million in the same period of the previous year. TV Azteca reported operating income of Ps.800 million, from an operating income of Ps.120 million a year ago.

Significant variations below EBITDA were the following:

Ps.22 million in income from affiliates compared to loss of Ps.132 million a year ago, mainly due to positive results of Grupo Orlegi this period compared to a loss in the same quarter of 2020.

Ps.305 million losses in foreign exchange this period, compared to a profit of Ps.345 million a year ago, as a consequence of the net liability monetary position in dollars together with a depreciation of the exchange rate of the peso against the dollar this period, compared with exchange appreciation the previous year.

A Ps.151 million reduction in assets impairment, due to cancellation of a provision for contingencies related to the Atlas soccer team the previous year.

TV Azteca recorded a net income of Ps.102 million in the quarter, from a net loss of Ps.77 million a year ago.

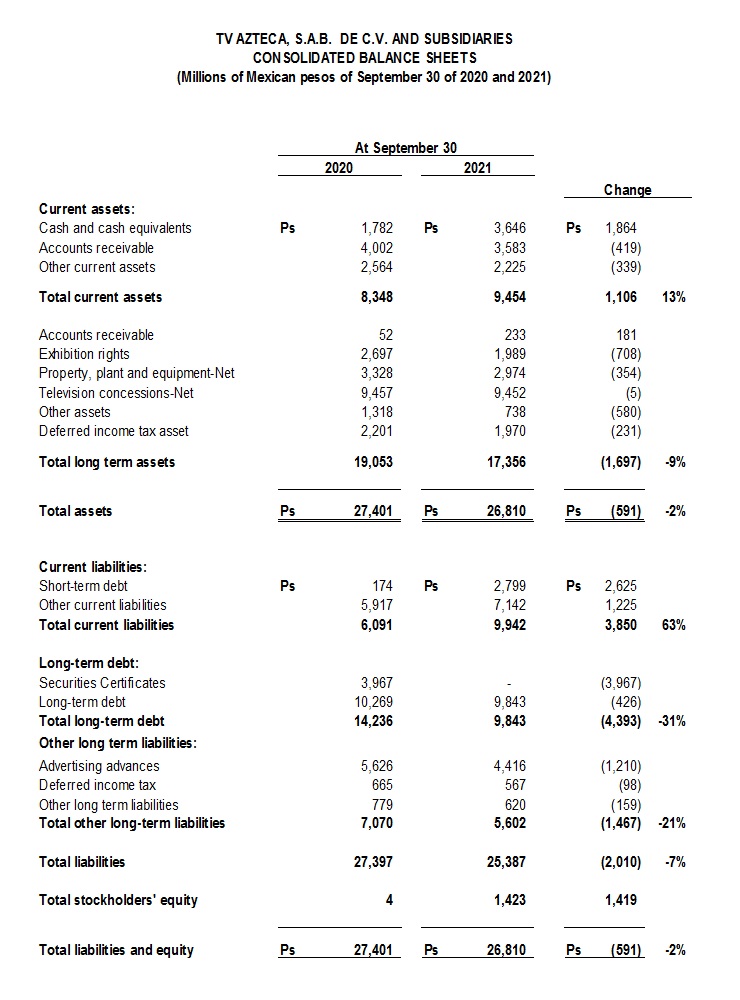

Balance Sheet

As of September 30, 2021, TV Azteca's debt with cost was Ps.12,642 million, compared to Ps.14,410 million from the previous year. The decrease is mainly due to a reduction in the balance of the company's Certificados Bursátiles.

In March, the company announced that it repurchased and canceled Ps.1,211 million of its Certificados Bursátiles with a principal of Ps.4,000 million due in 2022, as a consequence of the purchase of Certificates in the secondary market.

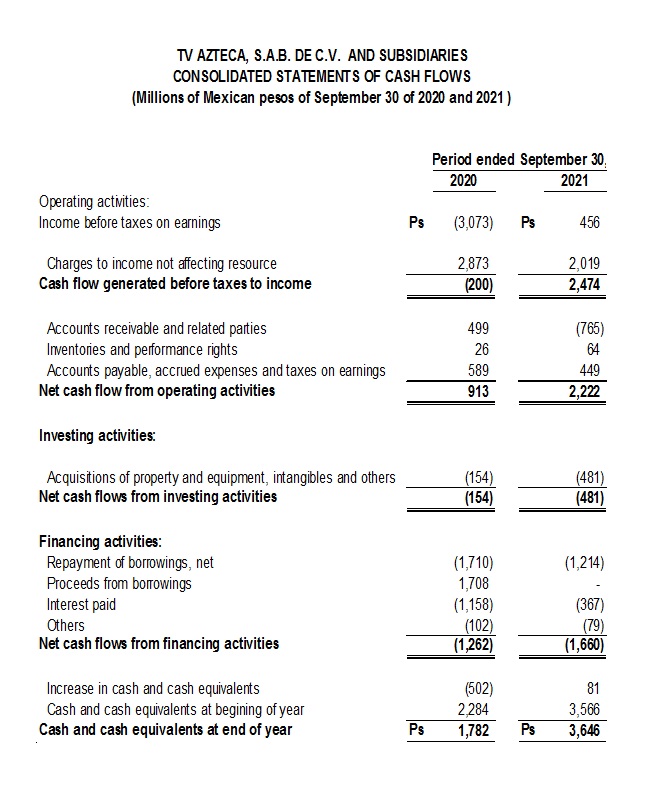

The balance of cash and cash equivalents at the end of the quarter totaled Ps.3,646 million, compared to Ps.1,782 million a year ago. The company's net debt as of September 30, 2021 was Ps.8,996 million, from Ps.12,628 million from the previous year.

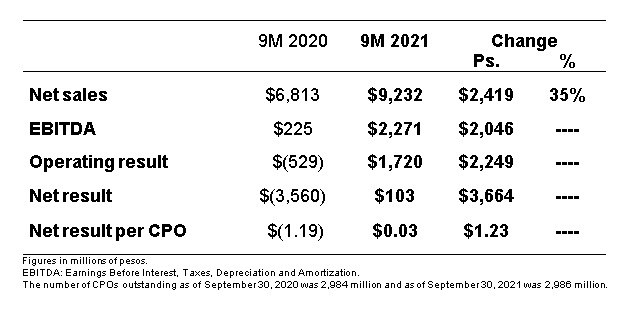

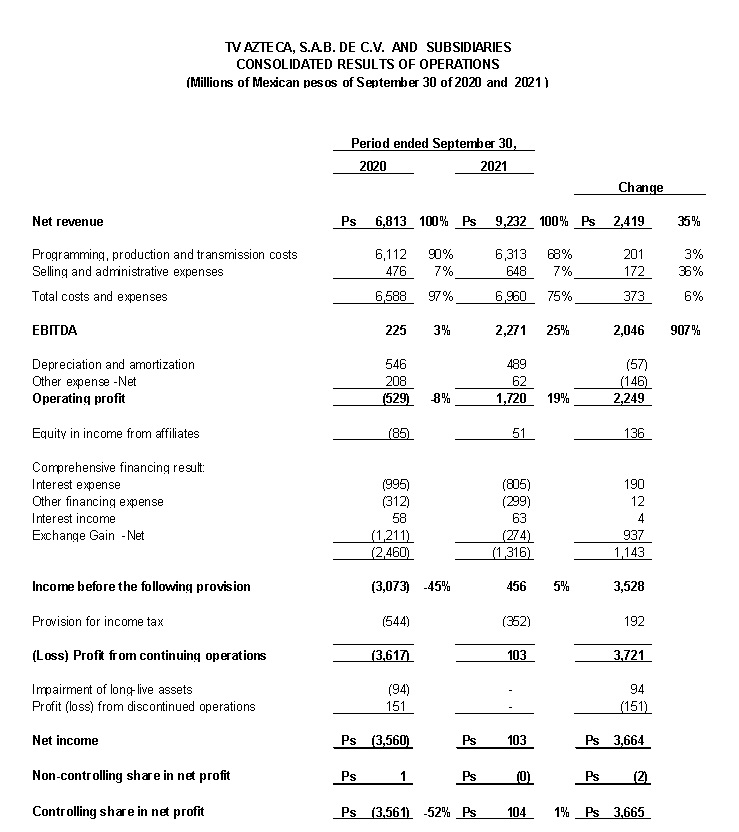

Nine months’ results

Net sales for the first nine months of 2021 grew 35%, to Ps.9,232 million, from Ps.6,813 million in the same period of 2020, largely as a result of higher demand for advertising space in the context recovery of economic activity indicators in Mexico.

Total costs and expenses were Ps.6,960 million, an increase of 6% from Ps.6,588 million in the same period of the previous year. As of result, TV Azteca reported EBITDA of Ps.2,271 million, compared to Ps.225 million in the first nine months of the previous year. Operating income was Ps.1,720 million, from a loss of Ps.529 million a year ago.

The company recorded a net profit of Ps.103 million, compared to a loss of Ps.3,560 million in the same period of 2020.